In the healthcare industry, there are a number of expenses that you will incur, that can be used to offset your income and reduce your tax bill. Throughout this blog, the phrase “allowable or disallowed” refers to whether the expenses may be used to reduce your profits when calculating your tax bill.

Personally Incurred Possibly Reimbursed?

All the expenditure to be claimed on your tax return in this way must have been incurred by yourself (if self-employed) or your company (if you operate a limited company).

If the expenditure is fully paid for by the practice or another 3rd party, then it should not be included on your tax return.

If you are reimbursed by the practice or employer for the expenses, then make sure you let us know these details, as it can vary from expense to expense how they should be reported on your tax return, depending on your circumstances.

Normal Expenditure

The following are typical expenses that I would expect to see as part of any self-employed individual’s tax return in the healthcare industry.

- Insurance for your professional work

- Professional subscriptions, such as with the GDC, MDDUS, BMA, RSM, etc.

- Costs of any professional publications

- Cleaning costs for any specialist clothing (e.g. scrubs and lab coats)

In addition to these, you may require equipment for your role that is not provided at the practice or hospital, such as loupes or a laptop.

Training Costs – CPD or Gaining New Skills?

One very important distinction regarding your training, is whether it is:

- Reinforcing skills that you already have, and use in your work (including learning about new technologies that relate to your existing work)

- Gaining new skills, before you can start providing these as a service.

Gaining new skills is NOT an allowable expense, so while it may open the door to new income streams, it is important to be aware that until you have reached the point when you start actively trading in the new skill, you will not be able to claim the costs for tax.

For your CPD and similar courses, however, these can be safely used to reduce your profits for tax, including any reasonable travel costs to attend (such as parking, mileage, etc.)

Travel Costs

For most individuals working in healthcare operating out of a practice, there are very few journeys that can be claimed for business use, that don’t fall into the disallowed ‘commuting’. Most people are limited to the following types of travel costs:

- Attending courses for your allowable CPD

- Being directed from your main practice/place of work to another practice owned by the same group

- Travelling to patients residences, for home visits

- Any journeys that you would invoice the practice for

Travel that is NOT allowed includes:

- Travel to arrive at your typical place of work (from home or from another unconnected business) and the return journeys.

- Travel in connection with disallowed Training costs

If you are self-employed, then you have the option to either:

- Include ALL vehicle costs for the year (road tax, insurance, fuel, and repairs), and claim a proportion based on the % allowable miles. E.g. If you had 850 allowable miles, but traveled 11,000 in the year, you could include 7.72% (850/11,000) of your total annual vehicle costs.

- Claim the HMRC basic rate of 45p/mile for the first 10,000 miles, and 25p/mile thereafter. Please note that the 10,000 miles are based on all your claimable business miles in the year, regardless of their source.

If you operate a limited company, then employees (and directors) can normally only use the 45p/mile option.

If you operate a limited company and your vehicle is held/owned by the company, then there may be tax issues surrounding any ‘non-business use’ – it is important to discuss this with us as soon as possible if it is the case.

Mobile Phone Costs

For any self-employed individual, any mobile phone costs can be allowed, to the extent that they relate to the business. For example, if you estimate that 5% of the phone’s usage is for business use, then you can receive the allowance of 5% of the phone’s costs.

It is important that you have a fair method to calculate the % business use, as if HMRC reviews your file, they may want some assurance of how that figure comes about.

If you operate a limited company an employee (including a director) can be provided with one business phone at any one time.

It is important to note that there is no requirement for this to be used for business purposes.

It is important if you do this to ensure that the contract is in the company’s name, not the individuals, otherwise, there may be tax implications.

Working From Home: Simplified Claims

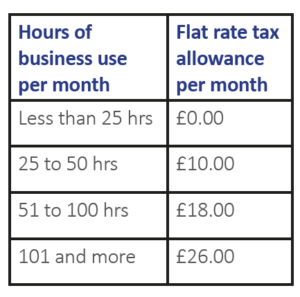

Self-employed individuals can claim a flat rate in their tax calculations, based on the number of hours they work at home per month:

- Hours of business use per month

- Flat rate tax allowance per month

If you operate a limited company, then if an employee has to work from home, then they can claim a flat weekly around £6/week – with a maximum being the total additional household costs incurred as a result of working at home compared to working at a different location.

Please note that this is only available when they need to work from home (either as their main place of work; because the necessary equipment is not available at the normal workplace, the commute is unreasonably far; or due to medical reasons (such as self-isolating). This is now available if you chose to work from home.

Given the inability for a number of healthcare practitioners to actually work from home (e.g. It is very unlikely for a dental practitioner to be able to perform a filling or x-ray at their home), this allowance is normally unlikely to be claimed, other than:

- Preparation work, reviewing medical history, and similar activities that can be carried out at home

- Phone consultations

Working From Home: Detailed Claims

Instead of using the rates listed above, the claimants may instead base their claim on their actual additional costs incurred as a result of working from home.

Other than this calculation, the availability is the same as under the simplified claims.

In a nutshell, this calculation could be made by considering the proportion of the number of rooms and the working hour’s availability, apportioning the typical home costs (gas, electricity, metered water, internet, and phone) by these.

Contact Us

Our specialist team can advise you on how to best manage your personal and business finances. Please get in touch with Matthew or Thomas today to see how they can help you!