Buying a property

Purchases of UK property are subject to Stamp Duty Land Tax (SDLT) if situated in England or Northern Ireland, Land Transaction Tax (LTT) if situated in Wales and Land & Buildings Transaction Tax (LBTT) if situated in Scotland.

Stamp Duty Land Tax

Stamp duty land tax has gone through numerous changes over the years. During the pandemic, for instance, people who were moving house enjoyed temporary property tax holidays that were in place around the UK. The stamp duty land tax holiday in England and Northern Ireland was the last to close, ending on 30 September 2021. The pre-pandemic regime returned for the 2022/23 tax year, charging 2% on property purchases above £125,000.

A stamp duty cut was then announced on 23 September 2022 to remain in place until 31 March 2025, increasing the residential nil-rate tax threshold from £125,000 to £250,000 for residential property purchased between these two dates.

Relief for first time buyers

The threshold at which first-time buyers begin to pay stamp duty land tax is £425,000 for property purchases entered into from 23 September 2022, rather than £300,000. Likewise, the maximum value of a property on which first-time buyers’ relief can be claimed is £625,000, rather than £500,000. A 5% tax charge applies to the portion of your new property’s value that falls between £250,001 to £925,000. The higher stamp duty land tax rates and thresholds also apply.

Additional residential property: 3% SDLT surcharge

Worldwide ownership is taken into account when considering whether a property is an additional residential property, meaning that if you own a property overseas, the 3% surcharge can apply to a first UK property purchase. A similar surcharge applies to LBTT.

The SDLT surcharge will mainly affect those buying second homes or rental properties as buy-to-let investments, but it may also have an impact on trustees. There is a specific exemption for trustees purchasing a main home on behalf of a life tenant or interest in possession beneficiary (for the purposes of these rules the beneficiary is treated as having acquired the property). This exemption does not extend to discretionary trusts, which are instead treated in the same way as companies (i.e. potentially liable to the surcharge in respect of even a first residential property purchase).

Companies purchasing residential property

Where a company or other ‘non-natural person’ is used to acquire a property costing more than £500,000, SDLT may be payable at a ‘super rate’ of 15%. Exemptions from this super rate apply, including for certain properties used in a letting or property development business.

The 3% SDLT and LBTT surcharge applies (with minor exclusions) to all corporate purchases of residential property where the 15% rate does not apply. LBTT and LTT are both, in broad terms, very similar to SDLT: the regimes are not, however, identical. This factsheet does not consider the differences, and anyone contemplating a Scottish or Welsh property purchase should ensure that they take appropriate advice on the position.

Occupation of the property

Companies

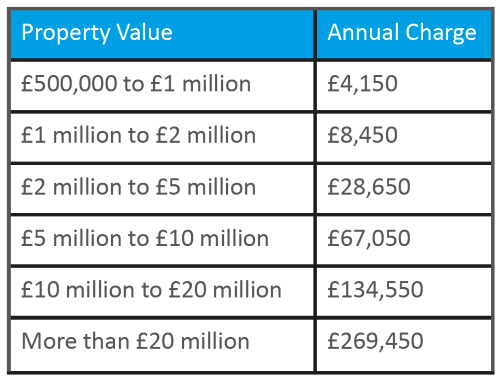

ATED applies to companies owning UK residential property which is worth more than £500,000. Where the property is occupied by an individual connected with the company, an annual flat rate tax (ATED) is due. The amount you’ll need to pay is worked out using a banding system based on the value of your property.

1 April 20203 to 31 March 2024

Renting the property

Individual

If an individual lets UK residential property they are subject to income tax at their marginal tax rates, i.e. up to 45% on the rental profit, regardless of their UK residence status. No deduction is available for finance costs, only 20% tax credit given on the finance costs. Properties let as furnished holiday lets are subject to different rules.

Companies

A UK resident company is subject to corporation tax on net rental profits at 19-25%. Deductions are available for revenue expenses, and there is no specific restriction on financing costs as applies to individuals and trusts. Any non-UK tax resident company which carries out a UK property business is subject to corporation tax at 19-25%.

If the shareholder/s of the non-UK resident company are UK resident individuals, or a settlor-interested trust where the settlor is UK resident, the underlying UK source income may be attributed to the shareholder/settlor so that additional tax at up to 45% is due (with a credit for the 20% tax paid by the non-UK resident company). In general terms, companies may be an appropriate acquisition vehicle for residential properties which are to be let out commercially (where no ATED or related charges should apply).

Non-Resident Landlords

Non-UK resident landlords (individual, corporate and trustees) are subject to 20% withholding tax on rents received unless an application is made to HM Revenue & Customs (HMRC) under the non-resident landlord scheme for rents to be paid gross. The 20% withholding does not discharge the non-resident’s tax liability if they are subject to tax at 45%, rather it is used as a credit against their tax liability.

OWNERSHIP OF UK RESIDENTIAL PROPERTY:

Inheritance Tax

UK inheritance tax (IHT) applies to UK assets which are directly owned, regardless of the residence or domicile status of the owner. IHT is chargeable on death at 40% in relation to assets held at death. IHT also applies to any gifts made within seven years prior to death, although there is a tapering of the IHT rate.

Prior to 6 April 2017, owning UK residential property through a non-UK company provided an effective IHT shelter for individuals who were not deemed to be domiciled in the UK. This is no longer effective from 6 April 2017 where a UK residential property is owned by a non-UK ‘close’ (i.e. not widely held) company. Under these new rules, the value of the shares attributable to the UK residential property is within the scope of IHT. Any loans made to purchase either UK residential property or any shares in a non-UK close company will also be within the scope of IHT.

Where residential properties are owned through a non-UK company post-5 April 2017, there are deeming provisions that give an ongoing IHT exposure for two years when the shares are eventually sold. This area is complex and specific advice should be sought.

Transfers of UK property into trust attract a 20% IHT charge and the UK assets will broadly be subject to a 6% IHT charge every 10 years, and a pro-rated 6% IHT charge on any distributions from the trust. Where the settlor of the trust retains an interest in the trust, in addition to these charges the property will remain in their estate for IHT purposes.

DISPOSAL OF PROPERTY

Gains on disposal of a residential property may be subject to UK capital gains tax (CGT), corporation tax, non-resident capital gains tax (NRCGT), or a combination of these. Since 6 April 2020, all gains for both UK tax residents and non-UK tax residents, must be reported through a CGT return and CGT paid within 60 days of the disposal. Penalties apply where a return is filed late.

Individual

Individuals are subject to CGT on gains realised on the disposal of residential property. Individuals selling their only or main residence should qualify for PPR relief so that the gain is not chargeable. CGT on residential property is charged at 18% or 28%, depending on whether the individual has any basic rate band remaining.

Companies

A UK resident company is subject to corporation tax at 19-25% on gains realised on the disposal of residential property.

A non-UK resident company is subject to corporation tax at 19-25% on gains realised on the disposal of residential property. In addition, anti-avoidance legislation may attribute the gain of a non-resident company to the shareholders. This is subject to a motive defense where it can (broadly speaking) be shown that the structure was not set up to avoid CGT or corporation tax.

At Dunkley’s we have a specialist property tax team who are experienced in advising property investors, developers, and entrepreneurs on structuring their businesses both from a commercial and tax perspective. We can help identify, implement, and manage the process of structuring your business so it is done in the most tax efficient way.

In addition to offering specialist business advice and expert tax solutions, we can also support you with the following:

- Audit

- Making Tax Digital

- Mergers, Acquisitions and Business Sales

- Cloud Accounting

- Tax Compliance & Planning

- Outsourced Finance Team

For more information on any of our services visit www.dunkleys.accountants

and keep in touch via our social media channels below for regular updates.